- April 19, 2024

-

-

Loading

Loading

Although the Manatee County Sheriff’s Office will get eight new deputies if Administrator Ed Hunzeker’s preliminary budget is adopted, Sheriff Brad Steube said the additional officers won’t be enough to create a new patrol district in eastern Manatee County.

Steube has a long-term goal to add a fourth patrol district that would focus on the greater Lakewood Ranch/east county area. Currently, the largest district, District 3, covers virtually all territory north of the Manatee River and east of Interstate 75.

The eight new deputies will bring Steube closer to his goal of an east Manatee County patrol district, but he said he still needs supervisors to make it a reality.

“It’s a step in the right direction,” Steube said of the possibility of adding eight new deputies.

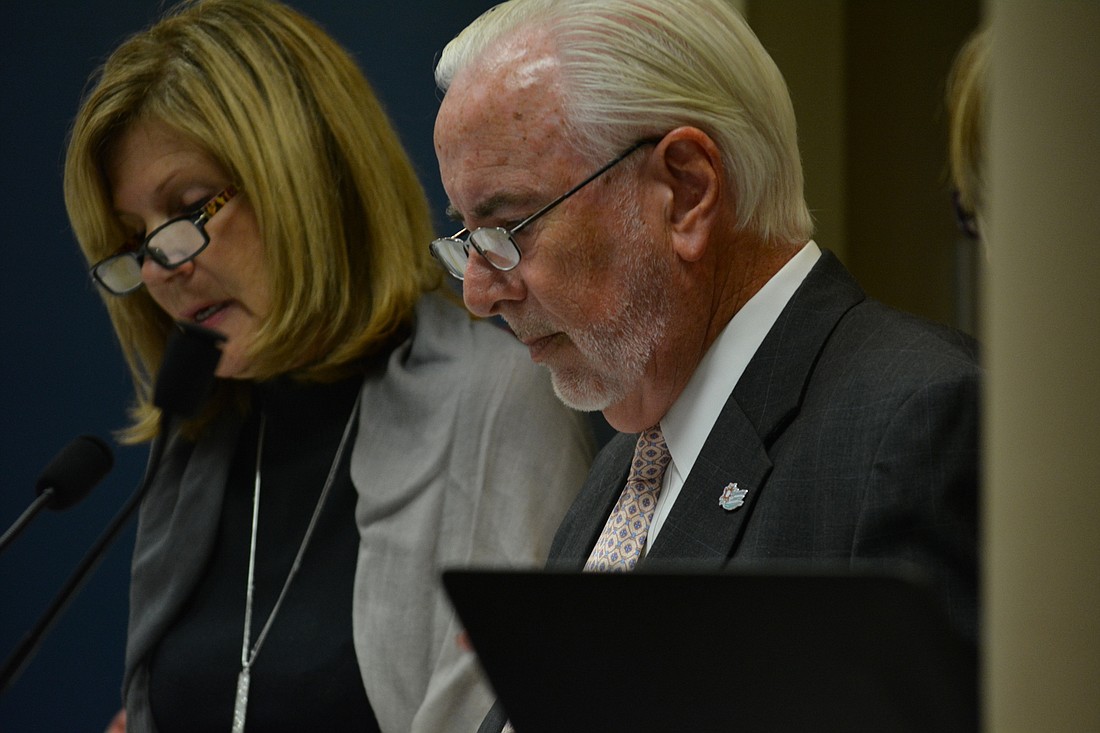

Hunzeker announced his proposed budget June 2, noting that increases in property tax revenues will aid Manatee County as it focuses budget dollars on public safety in Fiscal Year 2017.

He said a roughly 9% increase in property tax revenues will generate an additional $16.5 million in property taxes, which will be used for the eight additional law enforcement officers at the Manatee County Sheriff’s Office and the partial funding of eight additional School Resource Officers at middle schools, including Braden River, Haile and Nolan middle schools in east Manatee County.

The additional income also will fund the Marine Paramedic Rescue unit on Anna Maria Island and the establishment of a Community Paramedic Program, which sends specially-trained professionals into the community to provide health care services to individuals and help prevent unnecessary emergency room visits and hospitalization.

“The No. 1 priority has always been public safety,” Hunzeker said. “Since lowering our workforce by 300 employees since 2007, I have not recommended new positions funded by property taxes. Where employee positions have been added, they have been funded through user fees and enterprise funds. However, this year, with the growing population and heightened public safety demands, I have recommended 11 new property tax-funded positions.”

Steube will divide his eight new positions between patrol deputies and the corrections bureau. He will make his budget request to the county June 15 and is unsure if he will ask for more officers, but he said he definitely will ask for additional dispatchers.

In addition to sheriff’s deputies, Hunzeker’s recommended budget adds seven positions for public safety, of which three are funded through property-tax revenues.

The budget includes a 4% pay increase for county employees, who will receive merit-based raises ranging from 1 to 5%, to average 4% across each department.

Hunzeker is not proposing an increase in millage, which keeps millage unchanged for the 10th year in a row and results in a countywide operating millage at 6.4206. The figure is .016 lower than Fiscal Year 2016 because of bond debt that has been paid off.

Although the county is seeing above-average growth for the west coast of Florida, Hunzeker said the financial impact is not enough. Overall, the proposed budget again is reliant on reserves accumulated during the housing boom a decade ago. In Fiscal Year 2018, the county may be faced with compromising its longstanding policy of maintaining 20% reserves, if no changes are made.

“Our government continues to be challenged in our services and our workforce,” Hunzeker said. “Although this is a balanced budget, our funding model is simply not sustainable for the long-term financial health of Manatee County.”

Hunzeker said the commission will need to increase millage, modify its reserves policy or adopt a smaller budget that will result in workforce and service reductions, if it does not implement a half-cent sales tax recommended by the citizens financial advisory board in April. Such a tax would have to be approved by voters in November as a funding solution and commissioners have not yet agreed to place the tax on the ballot. Hunzeker’s budget does not include it at this time.

His proposed Fiscal Year 2017 budget (Oct. 1, 2016 through Sept. 30, 2017) develops a plan for major funding problem the county faces in 2018.

The county faces a $6.9 million gap in funding for indigent health care costs. Historically, that has been paid for through a health care trust fund, but it will be depleted in 2018. Thanks to the payoff of millage-funded debt, some property-tax revenues are now available to fund $2.9 million of health care costs. The rest will come out of reserves.

Hunzeker proposes adding $1 million each year from property tax revenue increases going forward, until the total amount is satisfied.

PROPOSED FISCAL YEAR 2016-2017 BUDGET

$567,921,690

COMPARED TO 2015-2016 Fiscal Year:

$563,871,866

THEN vs NOW

The county has 360,000 residents, which is about 60,000 more people than in 2007, but the 2017 proposed budget is 11% less.

Property tax revenues are estimated to increase by $16.5 million from Fiscal Year 2016 ($183,505,845) to Fiscal Year 2017. The 2017 number still will be $26.5 million less than in 2007.

LEARN MORE

Manatee County has budget presentation/workshops scheduled for:

9 a.m. June 14: Decision Unit Review

1:30 p.m. June 15: Constitutional Officers

1:30 p.m. June 16: Capital Improvement Plan

All meetings are held at the county administrative building, 1112 Manatee Ave. W., Bradenton.

* A budget reconciliation meeting is scheduled for Aug. 2 (millage rate will be adopted) and two public hearings on the budget will be held in September, at dates to be determined.

STORY

Although the Manatee County Sheriff's Office will get eight new deputies if Administrator Ed Hunzeker's preliminary budget is approved, Sheriff Brad Steube said the additional officers won't be provide enough manpower to create a new patrol district in eastern Manatee County.

Steube has a long-term goal to add a fourth patrol district that would focus on the greater Lakewood Ranch/East County area. Currently, the largest district, District 3, covers virtually all territory north of the Manatee River and east of Interstate 75.

The eight new deputies will bring Steube closer to his goal of an east Manatee County patrol district, but he said he still needs supervisors to make his goal a reality.

“It’s a step in the right direction,” Steube said of the possibility of adding eight new deputies.

Hunzeker announced his proposed budget on June 2, noting that increases in property tax revenues will aid Manatee County as it focuses budget dollars on public safety in Fiscal Year 2017. He said a roughly 9% increase in property tax revenues will generate an additional $16.5 million in property taxes, which will be used for the eight additional law enforcement officers at the Manatee County Sheriff’s Office and the partial funding of eight additional School Resource Officers at middle schools, including at Braden River, Haile and Nolan middle schools in East County.

The additional income also will fund the Marine Paramedic Rescue unit on Anna Maria Island and the establishment of a Community Paramedic Program, which sends specially-trained professionals into the community to provide healthcare services to individuals and help prevent unnecessary emergency room visits and hospitalization.

“The No. 1 priority has always been public safety,” Hunzeker said. “Since lowering our workforce by 300 employees since 2007, I have not recommended new positions funded by property taxes. Where employee positions have been added, they have been funded through user fees and enterprise funds. However, this year, with the growing population and heightened public safety demands, I have recommended 11 new property tax-funded positions.”

Steube will divide his eight new positions between patrol deputies and the corrections bureau. He will make his budget request to the county June 15 and is unsure if he will ask for more officers, but he said he definitely will ask for additional dispatchers.

In addition to sheriff's deputies, Hunzeker’s recommended budget adds seven positions for public safety, of which three are funded through property-tax revenues.

The budget includes a 4% pay increase for county employees, who will receive merit-based raises ranging from 1 to 5%, to average 4% across each department.

Hunzeker is not proposing an increase in millage, which keeps millage unchanged for 10th year in a row and results in a countywide operating millage at 6.4206. The figure is .016 different than Fiscal Year 2016 because of bond debt that has been paid off.

Although the county is seeing above-average growth for the west coast of Florida, Hunzeker said the financial impact is not enough. Overall, the proposed budget again is reliant on reserves accumulated during the housing boom a decade ago. In Fiscal Year 2018, the county may be faced with compromising its longstanding policy of maintaining 20% reserves, if no changes are made.

“Our government continues to be challenged in our services and our workforce," Hunzeker said. "Although this is a balanced budget, our funding model is simply not sustainable for the long-term financial health of Manatee County.”

Hunzeker said commissioners will need to increase millage, modify its reserves policy or adopt a smaller budget that will result in workforce and service reductions, if it does not implement a half-cent sales tax recommended by the citizens financial advisory board in April. Such a tax would have to be approved by voters in November, as a funding solution and commissioners have not yet agreed to place the tax on the ballot. Hunzeker’s budget does not include it at this time.

His proposed Fiscal Year 2017 budget (Oct. 1, 2016 through Sept. 30, 2017) develops a plan for major funding problem the county faces in 2018.

The county faces a $6.9 million gap in funding for indigent healthcare costs. Historically, that has been paid for through a healthcare trust fund, but it will be depleted in 2018. Thanks to the payoff of millage-funded debt, some property-tax revenues are now available to fund $2.9 million of healthcare costs. The rest will come out of reserves.

Hunzeker proposes adding $1 million each year from property tax revenue increases going forward, until the total amount is satisfied.