- April 27, 2024

-

-

Loading

Loading

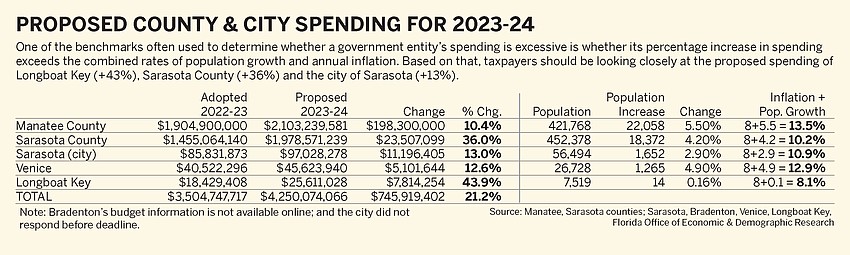

The numbers were jaw-dropping. The town of Longboat Key’s projected spending for the 2023-24 fiscal year is estimated to increase 43.9%. Sarasota County: an increase of 36%.

These percentages are stunning.

Less shocking, but still noteworthy: The city of Sarasota’s preliminary budget projects spending to rise 13%, and Manatee County’s spending is expected to go up 10.4%.

When was the last time you increased your personal spending 36% or 44% over the previous year?

Probably never.

Throughout most of Florida, local government budgets are gushing with bursts of cash, a result of mushrooming real estate values, which translates into mushrooming property-tax collections.

Because of a 12.5% increase in property values over the past 12 months, Longboat Key can keep the same tax rate and rake in $1.77 million more in new property tax revenue than last year.

A 13.5% increase in property values in the city of Sarasota will generate an additional $5 million in new property tax collections while the city holds its tax rate at 3 mills.

A 13.2% increase in property values in Sarasota County will generate $29.7 million in new cash while the county maintains its millage rate at 3.25.

And a whopping 25.7% increase in property values in Manatee County is expected to generate $62.6 million in new property tax collections while the county holds its tax rate at 6.43 mills.

The money is flowing in from other revenue categories as well. In his June budget message, Sarasota County Administrator Jonathan Lewis noted that through April the county’s half-cent sales tax revenue is “24.5% greater than was anticipated”; the infrastructure surtax revenue is 30.1% higher than budgeted; and the tourist development tax was showing “record-breaking revenues” and up 59.7% higher than budgeted.

Hey man, happy days are here again in city halls and county administration buildings. And it looks like most of these government bodies are primed to party — and spend.

It’s what they do.

You may recall two weeks ago in this space we pointed out how Gov. Ron DeSantis and the Florida Legislature are likewise taking advantage of the state’s robust economy and population growth. We noted how state spending in Gov. Ron DeSantis’ first five years in office has risen 36%, or by $31 billion compared to the 31% increase, or $19 billion increase in state spending that accumulated in Rick Scott’s eight years.

The state has so much money pouring in from the growth in population and the 22 million Floridians paying more for everything because of inflation — thank you very much, Donald Trump, Joe Biden and the dunces in Congress — that Florida lawmakers went hog wild, filling next year’s budget with a record number of local earmarks (e.g. “bridges to nowhere”): more than 1,540 projects worth $3.2 billion.

So likewise, when you start digging into the details of the town, city and county budgets, you’ll see how many of the local government city managers and country administrators are doing two things:

In that vein, Longboat Key Town Manager Howard Tipton, new to the job over the past four months, hasn’t caught on quite yet that Longboat Key town commissions have a long history of fiscal conservatism.

In Tipton’s early budget message, he is proposing to take $5 million from the town’s rainy day fund to apply toward infrastructure projects — the Broadway Roundabout, digital display boards on Gulf of Mexico Drive, road resurfacing, “pathway lighting” and streetlights.

Also in his budget: a 17% increase in personnel costs. That includes a 3.5% increase in pay for all non-union employees, with the option to increase their pay an additional 2% to 5% based on merit reviews.

But the big increases in pay will be going to firefighters and police officers, thanks to new union contracts: paramedics, +23%; lieutenants, 37%; police officers, 29.7%; and police sergeants, 30%.

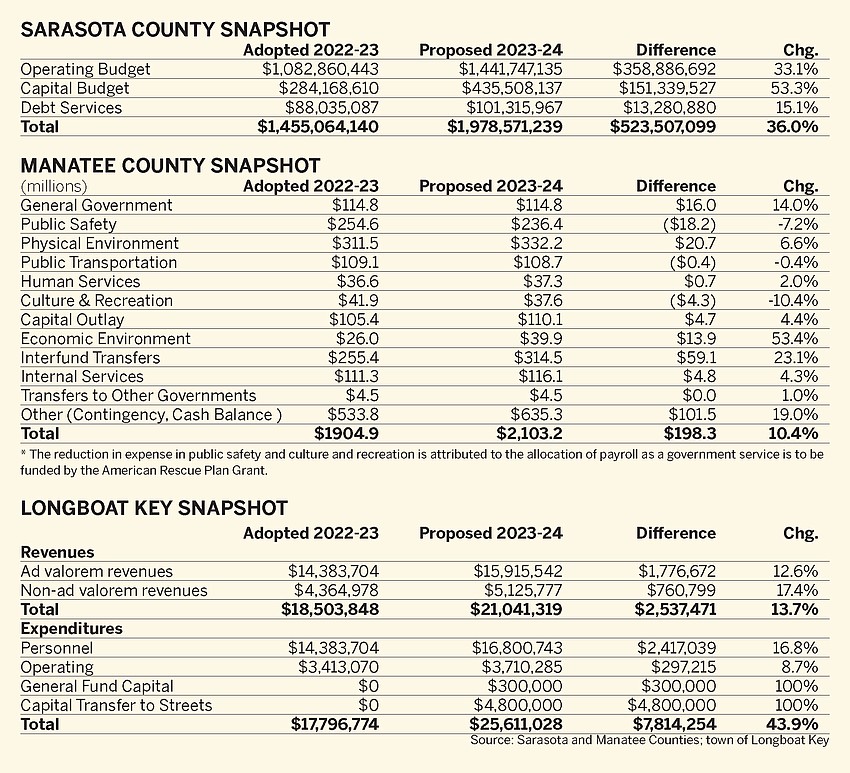

In Manatee County, Acting County Administrator Lee Washington is requesting an increase of $18.6 million for a 10% increase in the Sheriff’s budget. That would include the hiring of 20 new people in the department — 11 deputies, five corrections deputies and four executives and administrators.

In Sarasota County, Sheriff Kurt Hoffman is hoping to add 24 people, increasing his payroll to 1,060 people at a cost of $183.3 million, an increase of $30.3 million, which would be a 19% increase.

Everything is going up in Sarasota County — except one category. The Government Relations department is expected to cut its budget by a mere $10,900, a 0.5% decline. But for just about every local government entity in this region the story is the same. When the money is there, it’s difficult to resist the urge to spend it or keep it in reserves.

Give some of it back to taxpayers? Ha!

A recent exception has been the city of Sarasota, where City Manager Marlon Brown recommended — and the City Commission adopted — lowering the tax rate two consecutive years, largely because of the boom in downtown condo and hotel construction.

But with inflation running between 6% and 8% a year, we are seeing how public officials are less inclined to lower tax rates. Like consumers, they will make the argument they are enduring the same inflationary effects as their constituents. The costs of goods and services are going up for them as well. Longboat Key’s Tipton is projecting up to a 20% increase in flood insurance rates and 10% increase in electricity. In Manatee County, employee health insurance is expected to increase 11% for an employee, 40% for an employee and spouse.

So taxpayers likely will hear their city and county administrators — and most elected officials — make a case over the next two months that they are being conservative fiscal stewards of taxpayers’ money all the while they propose 10%, 30% and 40% increases in spending.

This is what happens during good economic times.

As a wise business investor told us once, it’s easy to figure out how to manage your business during an economic downturn — you have no choice but to cut expenses. It’s more difficult when you are flush with cash. You put your guard down and lose fiscal discipline.