- November 9, 2024

-

-

Loading

Loading

A month ago, we noted how county and city administrators in our region have proposed double-digit increases in their budgets for the next fiscal year. We said then: “The numbers were jaw dropping,” and the percentage increases were “stunning.”

The leaders: Longboat Key, a proposed 43% increase; Sarasota County, a proposed 36% increase.

We noted, too, that much of this proposed increase in spending could be attributed to two things — that just about every local government in the nation is flush with COVID-relief and inflation-reduction cash from the federal government, and from the robust increases in real estate property values.

And so, as governments do when you give them cash, they’re going to spend it. In most cases, local governments will be spending their windfalls on big infrastructure projects.

But many of them also are contending with the same things every household is confronting now, thanks to Joe Biden’s Inflation Increase Acts. They’re paying more for everything they buy, including employees’ salaries.

But even with government’s rising costs, with the huge windfalls of cash they have been taking in, you would hope your local governments would give taxpayers a break from inflation by cutting tax rates, specifically property-tax rates.

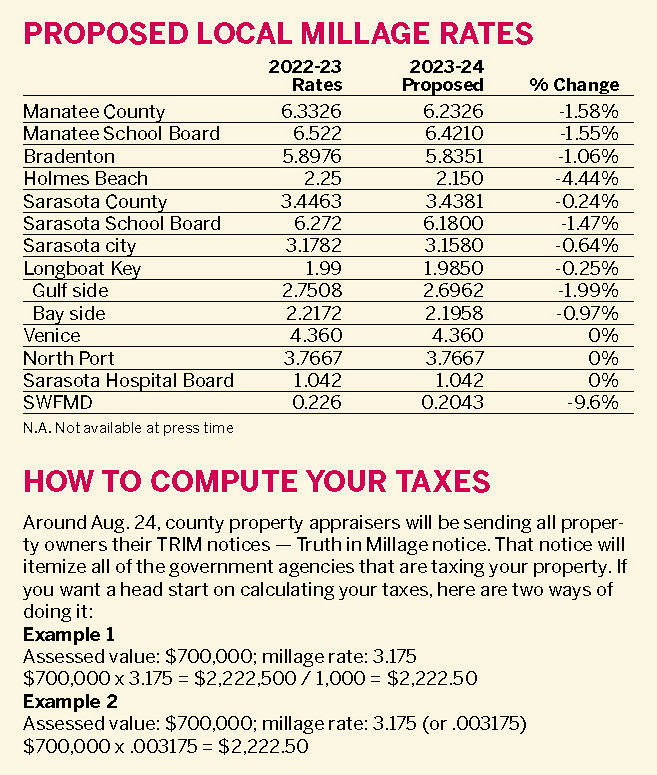

Well, as you can see from the accompanying table, most of our county and city administrators and city and county commissions are helping out their constituents. They’re throwing you the proverbial bone. As their revenues and spending will be rising at double-digit rates, your tax rates will be falling a pittance. The lone exception: Look at the Southwest Florida Water Management District. It’s cutting its tax rate 9.6%.

Why aren’t the other government entities giving you larger tax cuts?

C’mon. Dream on.

If you’re really hurting for something to do, go hunting online for your city or county’s proposed budget. From budget to budget, county administrators and city managers regale you with their financial stewardship and how well they’re managing taxpayers’ money.

And to be sure, all of the mountainous pages of budget documents do a thorough job of trying to be transparent for taxpayers — so you know where your money is going.

But here’s the thing: Every one of the proposed budget packets is an almost impossible challenge for taxpayers to follow and understand.

While each of the government entities is fulfilling their statutory obligations to disclose all the information they disclose in their 300-page books, the budget books are totally reader unfriendly.

Here’s what taxpayers want to know and see in the first page of every budget book: What is my tax rate going to be compared to the current rate? And show me a revenue and expense statement that compares this and next year’s spending and the percent change.

Those two things would be far more revealing and transparent to taxpayers than what they’re getting now.