- July 26, 2024

-

-

Loading

Loading

Longboat Key residents and property owners are blessed. Not just because of the great fortune to be able to live full or part time on this slice of paradise. But comparatively speaking over the past quarter-century, Longboat Key property owners and taxpayers have been blessed throughout most of its history with competent town commissioners and a competent, well-run town government.

So when the commissioners and town administration do good and do well, they should be recognized.

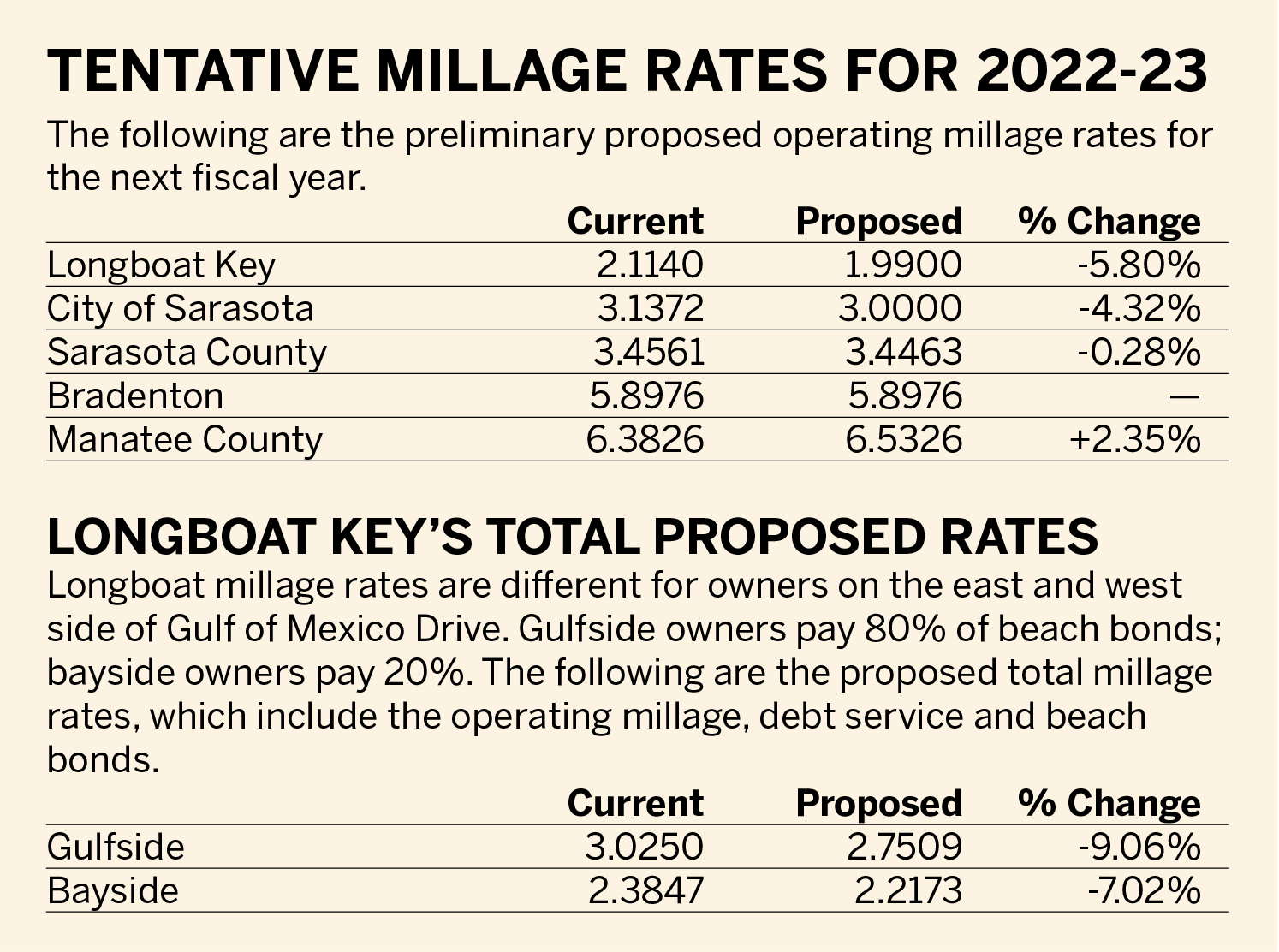

To that end, we’ve been watching how some of the area boards of commissioners and city councils are approaching this summer’s round of budget planning, in particular what they are proposing for the next fiscal year’s tax rates.

As many of us have heard and read, thanks to the euphoric jumps in real estate values, in most cases double-digit percentage increases, local governments will be collecting millions more next fiscal year in property taxes.

In Longboat Key, property values rose 14.39%, according to the Sarasota and Manatee counties’ property appraisers.

All of these increases mean these government entities are and will be awash in cash from property taxes.

Thanks to Florida’s Save Our Homes constitutional amendment in 1992, those increases, thank goodness, do not translate automatically to 14.39%, 16.6% and 17% increases in your property-tax rates. Save Our Homes limits tax-rate increases to 3% annually on homesteaded properties (full-time residents) and up to 10% for non-homesteaded properties (snow birds).

Even so, the increases in taxable values are going to translate into higher tax collections even if each of these government entities keep the same ad valorem millage rates.

Take Longboat Key. If town commissioners kept the current operating millage rate of 2.114 per $1,000 of taxable value for the next fiscal year, the town would collect an additional $1.88 million in property taxes above its current collections. That increase alone would be the equivalent of 13% of the town’s total budget. That’s huge.

To the town commissioners’ credit, though, they are on track to lower Longboaters’ tax rate. As the accompanying box shows, as of press time, the Longboat Key Town Commission is the leader of the pack among the two counties and the region’s two biggest municipalities in terms of proposing lower tax rates.

Kudos to them. Rare is the day when elected officials turn away all they can get and then spend it.

At the proposed operating millage rate of 1.99, the town still is expected to collect an additional $999,819, a nice boost.

Although commissioners could still cut the tax rate more between now and the adoption of the budget Oct. 1, we won’t argue or get greedy.

When you see total tax rates for Longboat Key dropping 7%-9% as proposed, perhaps you can be inclined to thank town commissioners for recognizing what so many other elected officials do not: that they are handling other people’s money.