- May 5, 2024

-

-

Loading

Loading

All Longboat Key parcel property owners recently received a letter from the town manager informing them of the special assessment program to fund the costs associated with the Gulf of Mexico underground utility project. The letter specifies the assessment amount and provided the following three payment options:

1) Payment in full on or before Aug. 15;

2) Equal annual payments for 30 years;

3) Cash payment any time after Aug. 15 of the remaining balance.

If you pay close to attention to your spending and investing, these options present different financial ramifications for property owners.

For most parcels, the full payment will be $2,424.47, or, the maximum annual 30-year installment — based on an estimated annual interest rate of 6% (the rate used by the town in its discussions), would be $182.51, or $5,475.30 over the life of the assessments.

While full payment clearly seems to be the least costly and simplest to do, it may not make the most economic sense. Here’s why: At this point, taxpayers know neither the total cost of the project, nor the interest rate on the bonds. These two important factors will not be known for one to two years.

So consider the following the three scenarios:

1) Will you overpay?

When the town estimated the cost of the project, one of the objectives was to establish a “not to exceed” cost, such that the town would be assured it would have sufficient funds under any circumstances.

As a result, based on my cost analysis of other similar projects, the town’s estimated cost far exceeds what Longboat Key’s project actually will cost.

This is important. For instance, if you opt to pay the full amount of the assessment in one payment and the cost of the project comes in less than projected by the town, the “GMD Initial Assessment Resolution (page 21) states: “The town shall not be required to refund any portion of a prepayment.”

In other words, you could end up overpaying the town.

2) Pay in full or invest?

Now consider the case if the interest rate on the bonds is below 6% — say, the 4.5% that the town also has used in its cost scenarios.

In this case, a property owner may want to make the $182.51 annual payments, with the thinking that he could earn more than 4.5% by investing the $2,424.47 that would have been spent by making one annual payment. Better to keep and invest your money than give it to the town to hold.

On the other hand, if the interest rate on the bonds does turn out to be 6%, a property owner might decide to pay the full amount, saving on having to pay all that future interest.

Here’s another twist: Let’s say in a year or two when the bonds are issued, the interest rate turns out to be less than what the town initially bills, what would the town do? Then the town has the choice to either adjust the annual payments downward or reduce the term of the bonds and retired the debt sooner. Asked about this, town officials were not certain, although they sounded as though they would lean toward reducing the term of the assessments.

The point is: Knowing the interest rate is crucial.

3) Least risky route?

Not knowing what the exact interest rate will be or the exact cost of the project, perhaps the least risky approach would be to make annual payments during the first one or two years. That way, you retain control of your funds.

Once the town determines the interest rate and total cost, you would then have sufficient information to decide whether to pay the balance at that time or continue with annual payments.

Although some property owners may feel their $2,424.47 Gulf of Mexico Drive assessment may not be significant enough to think about, the coming neighborhood underground utility assessment for some will be as much as $8,400. Combined, that would total $10,824.47.

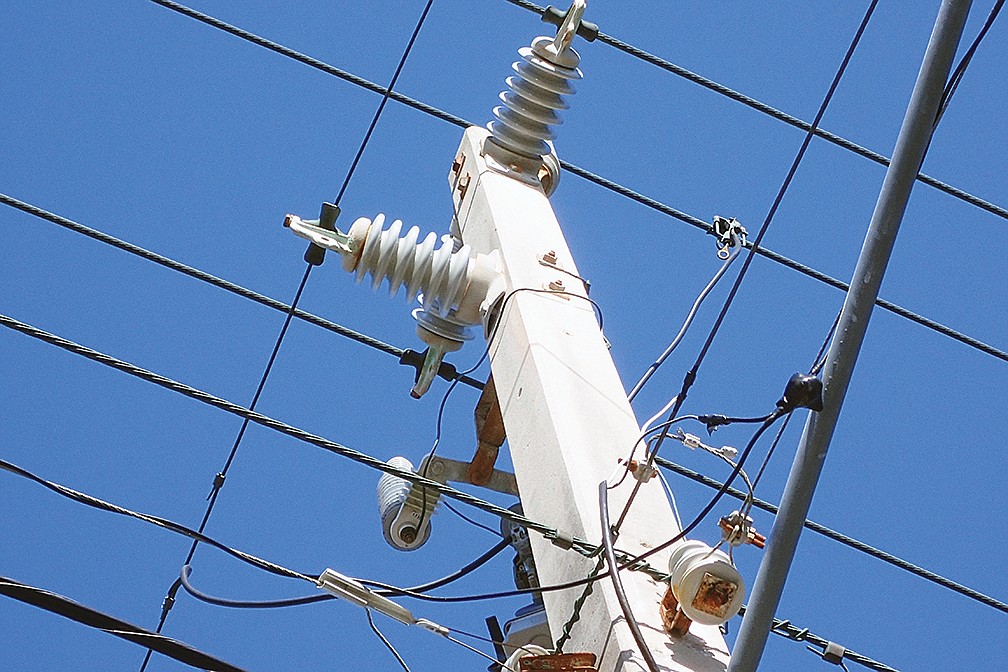

The bottom line: Voters have approved converting all of Longboat Key to underground utility lines, and the cost implications are starting to emerge. By understanding the ramifications of the payment options, property owners can better control the short- and long-term financial impacts.

For more information about the underground utility projects and costs, go to longboatkey.org.

Lenny Landau is a resident of Longboat Key, longtime engineer for General Electric and member of the Longboat Key Revitalization Task Force.