- July 26, 2024

-

-

Loading

Loading

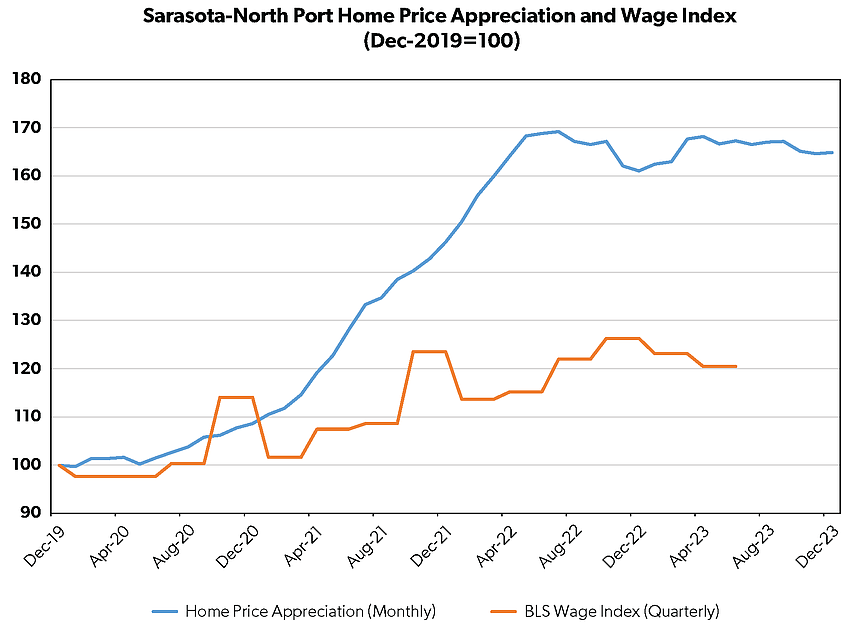

The problem: Sarasota faces increasing housing pressure as home prices vastly outstrip wage growth. Where will our children, grandchildren and the workers who provide us the services we all rely on live?

The main cause of rising housing pressure in the Sarasota area is an imbalance between home supply and demand, which is largely driven by employment growth and retiree in-migration.

To keep home prices reasonably affordable, Sarasota needs to grow its housing stock by roughly the same amount as its growth in employment and population.

Both Sarasota-North Port and Raleigh, North Carolina, had similar levels of employment growth; however Raleigh’s substantially higher level of new construction helped tamp down the rate of home price appreciation at about half that of Sarasota-North Port.

| 2012-2019 | Raleigh | SRQ-North Port |

| Employment growth | +26% | +25% |

| New housing | +33% | +21% |

| Price appreciation | +54% | +99% |

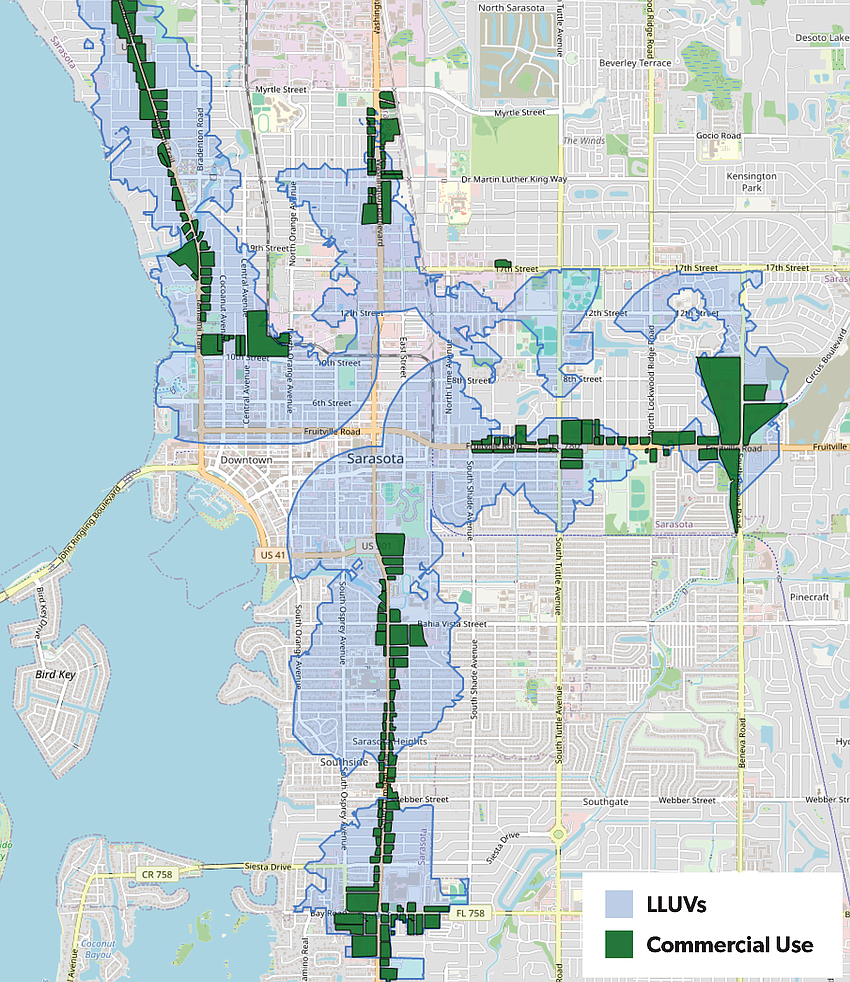

To address this, the Sarasota City Commission is proposing to designate urban mixed-use areas (UMUAs), which largely consist of commercially zoned areas outside of the downtown area that are zoned for commercial uses (shaded green in the map).

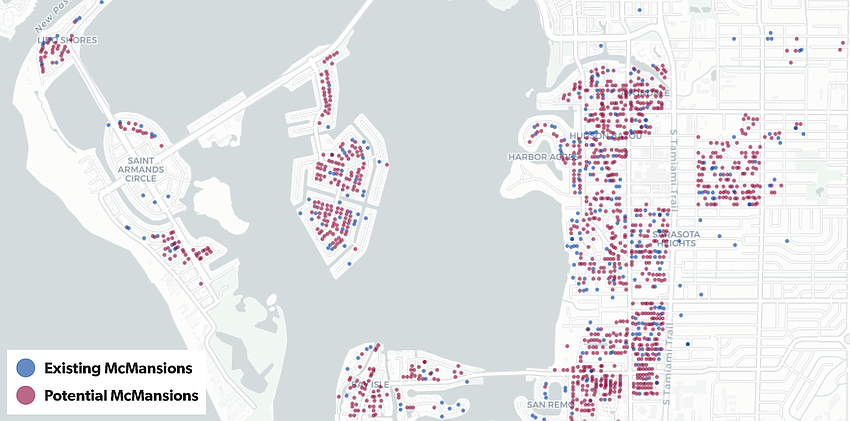

It would allow higher densities in these areas in return for the developer agreeing to have 15% of the units be income restricted relative to the median income for the Sarasota area, which for a two-person household is about $73,000. Five percent of the units need to be at 80% of median income and below, another 5% at 81-100%,and a final 5% at 101-120%. It is expected that over time this will result in substantial quantities of new construction, with most of the new units being rental units, leaving little opportunity for owner occupancy and wealth building. UMUAs, as an unintended consequence, will promote rapid McMansionization.

McMansions are super-sized homes that replace one-for-one, smaller, more moderately priced ones.

The solution: Create Live Local Urban Villages (LLUVs) by allowing light-touch density (LTD) in walkable areas within a half-mile of urban mixed-use areas.

This includes duplexes, single-family attached homes, accessory dwelling units and other homes compatible in scale with single-family detached homes. These homes would be within walking distance of growing numbers of service jobs in the urban mixed-use areas.

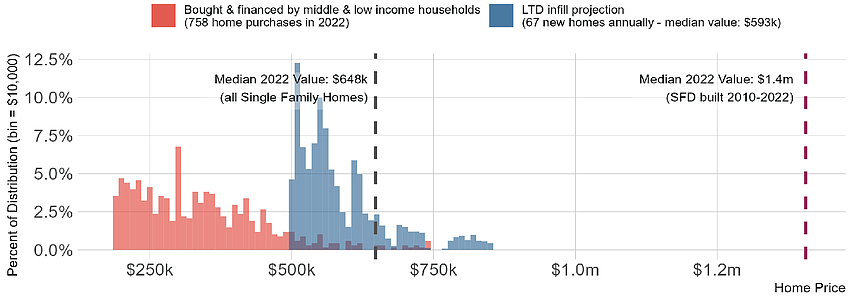

Sarasota’s housing permits would increase by about 20% annually, adding 97 units and 245 residents annually. This would reduce housing pressure, support economic growth and increase the city and county tax base. These homes would sell at about 50% of the value of recently built single-family detached homes.

Without this change, McMansions will spread throughout Sarasota.

The city of Sarasota has ample areas where new ordinances could create Live Local Urban Villages (LLUVs) by allowing light-touch density in walkable areas that are within a half-mile of urban mixed-use areas.

Applying light-touch density in Sarasota would create 97 new homes annually for 245 residents per year, providing more affordable homes for middle- and low-income households.

Live Local Urban Villages include parcels within a 1/2 mile of an urban mixed-use area. Purchases are in tracts intersecting the Live Local Urban Villages. Total light-touch density homes would include the addition of 67 infill homes, 30 accessory dwelling units and 0 greenfield homes (homes built on vacant lots).

The data assume 2.54 residents per household. Greenfield estimates are based on increasing 2019-2022 annual single-family construction as-built density by 30%.

Middle and low-income households are those earning less than 120% of the county’s median income in 2022.

Values are in dollars.

Light-touch density projections are based on a maximum of eight homes per existing single-family detached home lot.

Single-family homes include attached, detached and condos.

For more info: heat.aeihousingcenter.org.

Source: AEI Housing Center, HMDA, public records

Over the last 10 years:

Our future:

Note: Conversions are likely underestimated on Lido and St. Armands keys because of insufficient data.

Edward Pinto, a longtime St. Armands Key resident, has spent 50 years in the housing and mortgage industry. A lawyer, he has served as chief credit officer of Fannie Mae, 24 years as CEO of Courtesy Settlement Services, a closing service for banks; and currently serves as senior fellow and co-director of the American Enterprise Institute’s Housing Center. His research focus is on market-driven expansion of affordable workforce housing. Pinto wrote and compiled the information on this page for the Observer. He can be reached at [email protected].