- July 26, 2024

-

-

Loading

Loading

Gov. Ron DeSantis recently signed Senate Bill 7024, which makes several changes to the Florida Retirement System, the state’s retirement plan for government workers. And let’s say there is good news and bad news.

The good: A change to improve the long-term viability of the state’s defined contribution plan. The bad: More risks and costs to an already strained public pension system.

Most Sarasota city and county and school district employees are in the FRS. Indeed, only a minority of government workers getting their retirement benefit from FRS are state employees: about 48% are employed by school districts, 24% by counties, 14% by the state, 8% by universities and colleges and 6% by cities.

This year’s reforms roll back several cost-saving reforms that were implemented in 2011 for public safety workers, an unfortunate move considering the pension system is still on a long path to becoming consistently fully funded.

The plan has about $38 billion in unfunded liabilities and still relies too much on higher-than-realistic investment returns, even after taking a $14 billion loss in fiscal year 2022.

Instead of adding more benefits with unpredictable costs, lawmakers should direct their attention to eliminating the pension debt that has loomed over state budgets and taxpayers for decades.

Alongside this potentially costly change comes a positive development for Florida employees and taxpayers. Florida government employers will increase their contributions to the state’s defined contribution plan — similar to a 401(k) — dubbed the Investment Plan.

While this contribution increase comes with a cost increase for those governments, it’s crucial for the benefit adequacy of the defined contribution plan, which is a key component in the state’s effort to reduce long-term pension risks and costs for taxpayers.

Florida’s Investment Plan has been a valuable retirement savings option for public workers since 2002. After years of wrestling with unpredictable runaway costs associated with FRS’ traditional defined-benefit pension plan, state legislators voted to make the existing defined contribution plan the default option for new hires — excluding police and firefighters — beginning in 2018. Now, the majority of newly hired teachers and government workers participate in the Investment Plan, making it the state’s primary retirement plan and a keystone of the Florida Retirement System for the foreseeable future.

With its increasingly prominent role in providing retirement security for the state’s government workers, many began taking a closer look at the Investment Plan’s long-term viability.

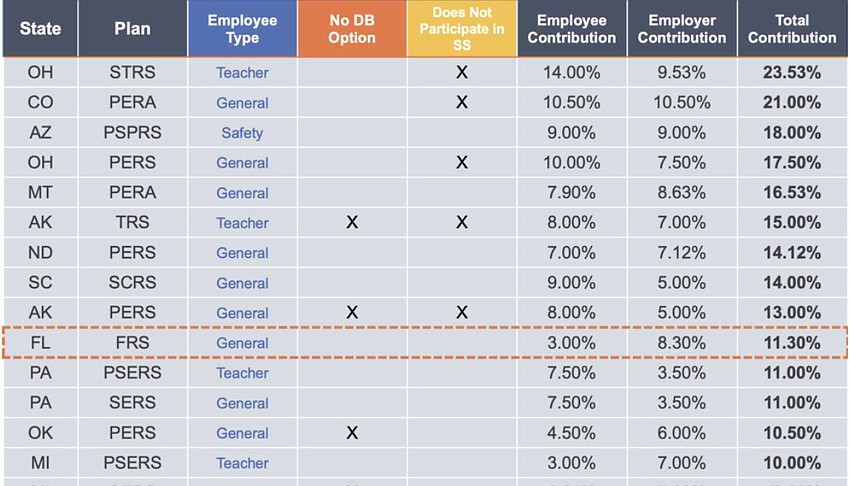

Unfortunately, the state set up the Investment Plan with the lowest employer contribution rate among all states with similar retirement plans. This meant that even if state and local government workers put in the maximum amount allowed out of their own salaries, they would not have enough money in their retirement plan when they reached retirement age. This put the employee’s retirement security in extreme risk and taxpayers at risk to bail the system out years from now when it is much more expensive to do so.

The Reason Foundation warned the state in legislative testimony and reports in 2021 that this was a problem in urgent need of repair. In 2022, the state took the first step with a 3% increase in employer contributions for all members participating in the Investment Plan.

This raised Florida up to at least compete with the lowest contributors among other states offering similar plans, but it still remained the lowest on this list. That brought total contributions per year per employee up to a max of 9.3%, which was still well below industry guidelines of 12% to 15% of pay going toward retirement.

This year’s reforms increased employer contributions by another 2%, bringing total employer contributions to 8.3%, with employees still contributing 3%, for total contributions of 11.3%. This is closer to the industry standard, and as the table shows, in the middle of the range offered by states with comparable retirement plans.

However, Florida policymakers should not surmise that their work is done. The next round of reforms should look to increase employee contribution rates, which have remained at 3% for decades.

Florida policymakers should also be wary of more calls to undo previous cost-saving reforms. Despite a still-growing $38.3 billion shortfall in assets needed to cover pension promises already made to FRS members, some have taken the state’s recent budget surpluses and renewed calls from public unions about recruitment and retention challenges to justify costly boosts to retirement benefits. Adding more pension liabilities while the state is having trouble paying for the ones already promised is bad practice and exacerbates a costly problem for Florida taxpayers.

At the same time, Sarasota area school districts, the city of Sarasota and Sarasota County will see some increased costs as they must make higher contributions to both the Investment Plan and the pension plan for their workers. But that is far better than allowing the retirement plan to continue on its previous unsustainable path with rapidly mounting costs for future taxpayers. It is far more efficient to pay the costs now and each year than to let these plans build into a kind of massive balloon payment.

Florida policymakers’ contribution improvements to the Investment Plan are prudent steps toward achieving the difficult task of providing adequate retirement benefits for public workers at a responsible level of risk and cost to the taxpayer. By improving the state’s defined contribution plan, they are bolstering its long-term plan of reducing runaway costs, which will be instrumental in reducing and preventing expensive pension debts for future generations.

Florida policymakers should continue to seek reforms that strengthen the Investment Plan and reduce the risks of public pension debt. It is important to vigilantly guide FRS all the way back to full funding without adding more risks of runaway costs.

Zachary Christensen is managing director of Reason Foundation’s Pension Integrity Project, and Adrian Moore is vice president at Reason and a resident of Sarasota.