- July 26, 2024

-

-

Loading

Loading

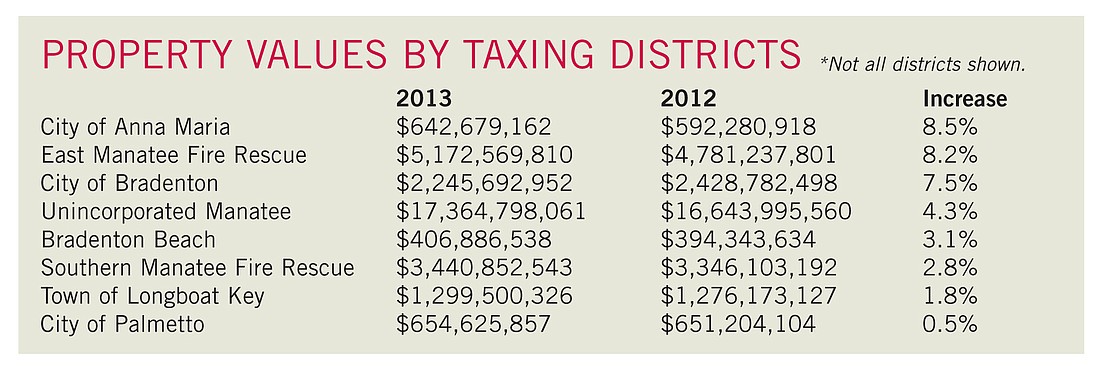

MANATEE COUNTY — Property values in Manatee County are on the rise, with Lakewood Ranch and other East County communities experiencing higher-than-average increases.

Preliminary certification of taxable values, released July 1 by the Manatee County Property Appraiser’s Office, shows values have increased an average of 4% compared to last year.

Mark Johns, director of appraisal services for the property appraiser’s office, said beach properties, the Lakewood Ranch area and newer subdivisions around the East County community showed the highest increases.

Countywide gross taxable value for the 2013 tax roll is $24.14 billion, compared to $23.21 billion in 2012.

“Of that $24 billion, there is $364 million worth of new construction countywide,” Johns said. “From last year’s taxable to this year is a 4% increase, but some areas experienced greater increases than others. The beach communities and the Lakewood Ranch area and the newer subdivisions out to the east showed the highest increases, (but) areas like Palmetto and Bradenton proper showed very marginal increases in value.“

The new tax roll indicates new construction is up considerably compared to 2012, and also that the real-estate market is improving, Johns said.

Manatee County Administrator Ed Hunzeker said much of the value increase seen in the East County area is directly attributed to new development.

County financial planners had anticipated a 3.1% countywide increase in values.

The higher values are expected to produce about $1.3 million more in revenue for Manatee County’s 2013-14 fiscal year budget, Hunzeker said.

The county must file a budget July 15. Hunzeker said the extra revenues likely will be marked as reserves, for now.

Then, the Manatee County Board of County Commissioners will decide how to utilize the funds, after Hunzeker delivers an updated budget to the board Aug. 1, at which time commissioners are slated to set millage rates and address issues that were flagged during reviews of the budget.

Hunzeker said the $1.3 million from property taxes could be used in four ways: to deal with future indigent health-care costs; to reduce the county’s dependence on its reserves; to partially fund capital-improvement projects so the county has to borrow fewer dollars to pay for the projects; or to use the money for strategic investments in technology, to reduce future costs.

“None of those relates to growing government spending,” Hunzeker said, noting the decision will be up to commissioners. “I continue to caution against growing government until we’ve reduced and eliminated our dependence on reserves.”

Contact Pam Eubanks at [email protected].