- February 4, 2026

-

-

Loading

Loading

Aside from the commission race, the Longboat Key ballot included a critical referendum about the town’s underwater wastewater main replacement project. The referendum passed overwhelmingly with 94.7% of voters in favor of the loan option.

The unofficial results Tuesday night read 1,545 voters of 1,630 approve of the referendum.

The referendum asked Longboat Key voters if the town should pursue a loan of up to $33 million through the State Revolving Fund (SRF) loan program.

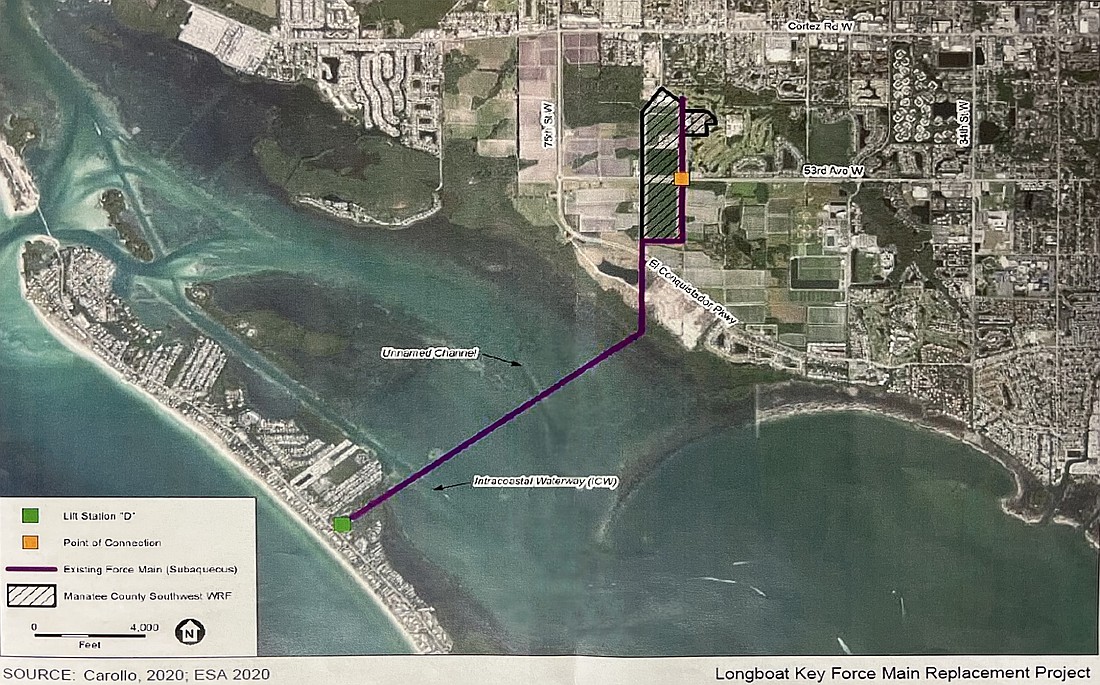

This will be used to cover the cost of the town’s required replacement of the subaqueous force main that transports the town’s wastewater to the mainland, where it's under Manatee County treatment.

The current pipe is about 50 years old and extends 2.8 miles under Sarasota Bay.

Following a fracture in the pipe in 2020, the town was required to replace the pipe through a consent order given by the Florida Department of Environmental Protection. This led to the mainland portion of the pipe being replaced in 2023 for $2.6 million while the town began preparing for the underwater portion.

This is the more expensive part of the project, which the town anticipates will cost around $27 million. The project will replace the existing 20-inch ductile iron pipe with a new, 24-inch high-density polyethylene pipeline.

The town was granted a $3 million state appropriation with help from Congressman Vern Buchanan and requested another $1.5 million in the upcoming legislative session.

Still, a large funding method was required, and the town looked to the SRF loan. This option required a town referendum, though, since the loan requires a secondary pledge as insurance.

The SRF loan comes with an interest rate of 2.89% and will cost the town $37.6 million over time.

If the referendum failed, the town would have had to pursue revenue bonds with either 20- or 30-year terms at an interest rate of 5% or 5.51%, respectively. This would have led to total costs of $45.9 to 58.5 million.

Revenue bonds would have also meant the town would have likely needed to raise utility rates if the referendum failed, since that’s the primary method of paying back the cost of this project. The town’s last rate adjustment schedule accounted for the SRF loan.