- April 28, 2024

-

-

Loading

Loading

“Huge, outdated, voracious dinosaurs.”

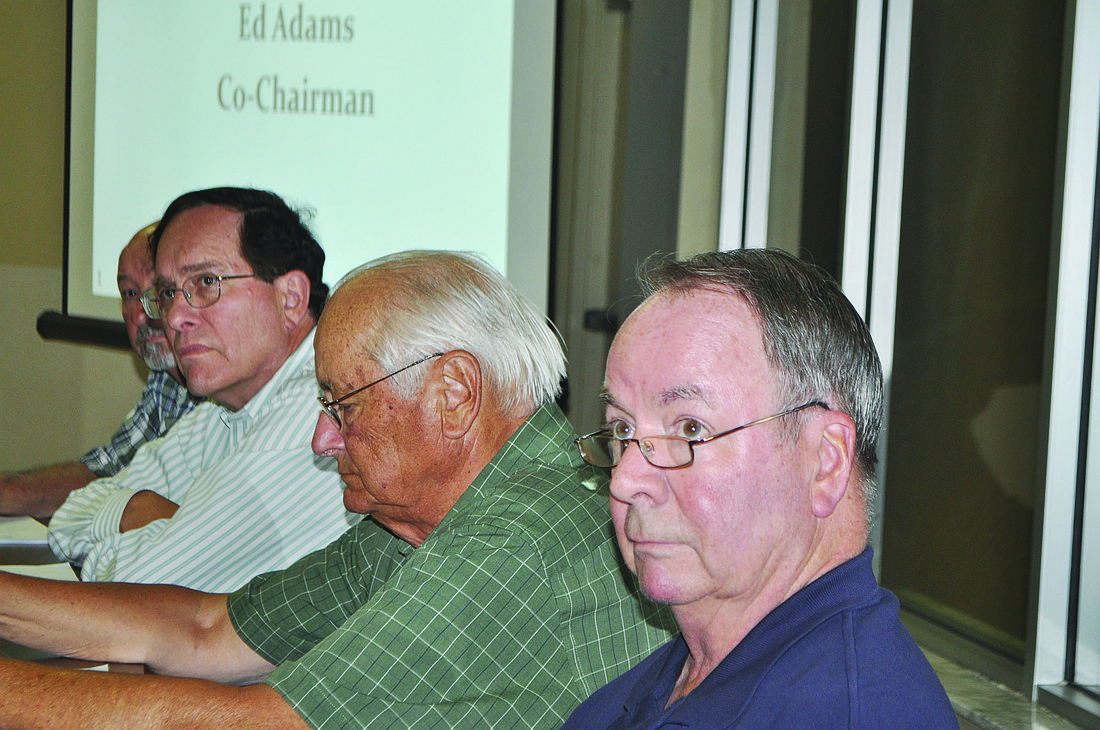

That was how Key resident and PIC Pension Committee Co-Chairman Ed Adams described the town’s three pension plans at a Longboat Key Public Interest Committee pension forum.

Approximately 40 people attended the hour-and-a-half session Wednesday, March 9, at Longboat Island Chapel, and listened as five Key residents and former businessmen described the ins and outs of the town’s plans.

Since November, the five men investigated the town’s three plans to make recommendations about the plans, which have approximately $26 million in unfunded liability.

Adams explained that the committee’s mission was to study the plans, educate the public on how they work and develop alternatives for town officials that will enable the town to address current and future retirement plan issues.

The committee is made up of Bill Forcht, Larry Linhart, Randy Clair and Co-Chairmen Adams and Dick Antoine.

“They are beginning to eat away at every tax dollar on the Key,” Adams said about the plans.

Forcht said the three plans’ unfunded liability issue is “growing larger by the day.”

Antoine said he understands the town has legal obligations to fund the pension plans for current employees.

“But the path we believe we are on is very concerning,” Antoine said. “We estimate the $2.7 million responsibility to taxpayers today will increase to $4 million to $6 million per year going forward to pay liabilities. The bottom line is we are heading toward a financial crisis and town employees and taxpayers face difficult situations going forward.”

Antoine noted that town contributions have risen from $414,000 a year to $2.8 million a year in a 10-year period, for a seven-fold increase in a decade.

“Similarly, contributions are eating up an ever increasing portion of our tax revenues,” Antoine said. “We are not in decent shape.”

Linhart explained that the options include keeping the plans, while reducing benefits and/or increasing contributions.

“But the town doesn’t belong in the pension business,” Linhart said. “The town should transition to a defined-contribution plan that excludes unused vacation and sick time as part of its final compensation to employees.”

Linhart said the town should move quickly to make decisions, especially regarding future employees.

“The sooner these problems are addressed, the better off the town will be,” Linhart said.

Contact Kurt Schultheis at [email protected]