- April 26, 2024

-

-

Loading

Loading

Monday through Friday, Katie Walters wakes up before the sun rises.

Walters, an Out-of-Door Academy teacher who lives in Lakeland, heads for State Road 60 for her nearly two-hour commute to Lakewood Ranch.

"You could say I'm a dedicated teacher," Walters said, laughing.

For the last month, the 25-year-old and her husband, Jason, have been looking for a home in East County or west Bradenton to shorten their travel time to work.

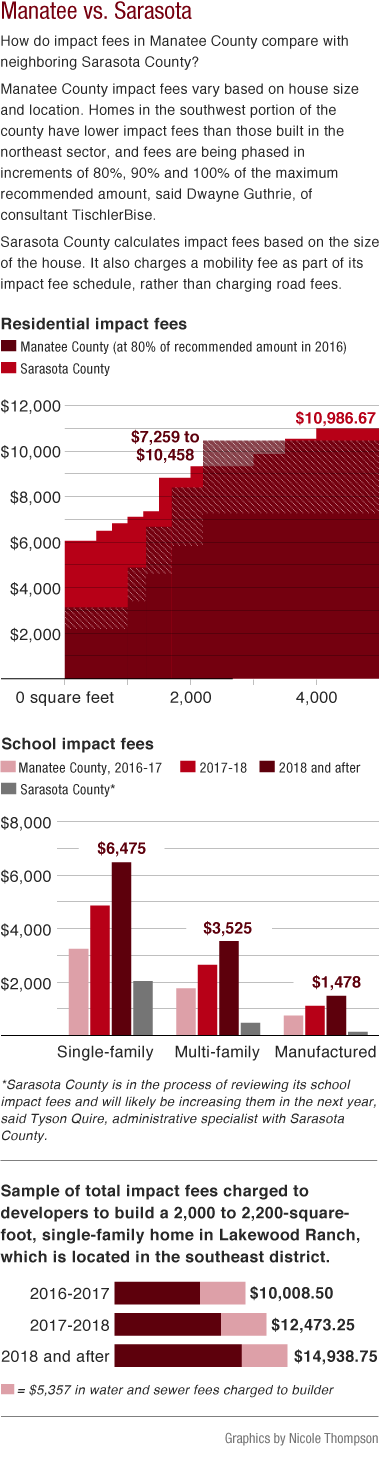

Their $200,000 to $250,000 budget for a three-bedroom home in Manatee County may be squeezed tighter than expected now that the county will again charge educational facilities impact fees that will be on top of the county's impact fees on new development.

On Jan. 7, Manatee County School District Chief Financial Officer Rebecca Roberts said because of capacity issues, Manatee County Commissioners approved the reinstatement of school impact fees, which will help fund new schools needed throughout the county.

The district needs a new high school and up to five other schools countywide to accommodate the growing population.

School impact fees will be phased in increments of 50%, 75% and 100% of the maximum amount recommended by consultant TischlerBise.

Starting in April, developers will pay $3,237.50 on new single-family homes just for school impact fees. They will also pay the allotted county fee for the house, which varies depending on size and location.

The fees will continue to increase until the school impact fee reaches the maximum supportable fee, which is $6,475 for a single-family home in 2018.

For Walters, who hopes to move to Manatee County as soon as possible, a new single-family home spanning 2,000 to 2,200 square feet in Lakewood Ranch will generate a $10,008.50 impact fee — the total of county and school fees added together — if it is purchased between April 2016 and April 2017.

The fees, which are one-time fees on new residential development in Manatee County, cover costs associated with growth, such as more roads and schools needed to accommodate new residents, and are assessed to developers — on paper.

"This extra cost is going to the consumer and that bothers me," Commission Chairwoman Vanessa Baugh said. "This isn't about the developer, it's about the consumer."

Developers are likely to pass along the impact fees to homeowners by increasing the prices of homes, said Pat Neal, of developer Neal Communities.

"That fee is passed on 100% to the consumer," Neal said. "Younger families are the ones being hurt. Most of my retired customers sell their homes in Ohio and pay cash for their new home in Lakewood Ranch. But young people who have a mortgage, if they're paying more each month, they are impacted."

Neal estimated that the average price of homes he sells is $346,000. Depending where he builds and how big the home is, Neal said impact fees cost his company more than either labor or concrete.

The extra dollars likely will be reflected in a higher monthly mortgage payment, a bite-sized way to push that additional cost forward.

"Everyone wants to see consequences of growth paid for," Neal said.

Gloria Bracciano, a real estate agent with Premier Sotheby's International Realty in Lakewood Ranch, said the extra cost will hurt first-time and younger homebuyers more than other demographics.

Her clients who purchase homes in the Lakewood Ranch Country Club pay between $300,000 and $5 million for a home, she estimated.

"They aren't concerned with a little more each month," Bracciano said. "Most of my buyers pay cash for their homes. But someone with a tighter budget or who wants to stay near the $300,000 range would notice that amount more."

Suzanne Hatt Lipscomb and her husband, Peter, already live in the Lakewood Ranch Country Club, but they want to move into a bigger home. They plan to upgrade to a home of 2,700 square feet or more.

The houses she has viewed are pre-existing and cost at least $600,000. But if she and her husband decided to buy a new home, she wouldn't be affected by the additional cost of impact fees.

"We really like the Country Club," Lipscomb said. "There are a few lots in here where we could build. Paying a little more each month wouldn't discourage us from buying a new home."

The Walters have a boat and a camper, which they currently store outside of their home in Polk County. If they move into a neighborhood that has a homeowner's association, they will likely have to store the boat and camper offsite.

Katie Walters can deal with those storage charges, but impact fees would pose an unforeseen expense.

"If it were up to me, I’d love to live in a new home with a park, pool and all that," Walters said. "My husband is on the opposite side. It's hard for him to understand why he would pay extra in addition to a mortgage and for us to not have our boat or camper nearby."

With the school district's emphasis on capacity issues, especially in schools out east, such as Lakewood Ranch and Braden River high schools, residents overwhelmingly supported the decision to bring the impact fees back from hiatus.

Because of her profession as a teacher, she also understands why the impact fees are needed, and tries to keep an open mind about paying more each month to benefit schools.

"Fees charged for most anything else would make it easier for me to say, 'No, I won't live there,'" Walters said. "At least the school impact fees are going toward something that makes public schools better."

The district stopped collecting the fees in 2009, because it felt that no new school construction was needed then, School Board Chairwoman Karen Carpenter said.

Today the district is booming, school board members said.

"Growth should pay for growth," Carpenter said.

And it will — with a catch.

One of the biggest money makers for the school district, the Half-Cent Sales Tax is set to expire in 2017 unless voters approve to extend it in November for 15 more years.

If the tax, which generates millions of dollars for the district, doesn't sunset next year, the district will bump the school impact fees back down to half of what TischlerBise recommended.

County commissioners didn't like that the school board tied the two revenue streams together in an if-then way.

"We need to get as much funding as we can for our schools, for our students," Commissioner Charles Smith said. "I think we need to be charging 100% of the maximum amount. We need to do what's best for our children."