- April 19, 2024

-

-

Loading

Loading

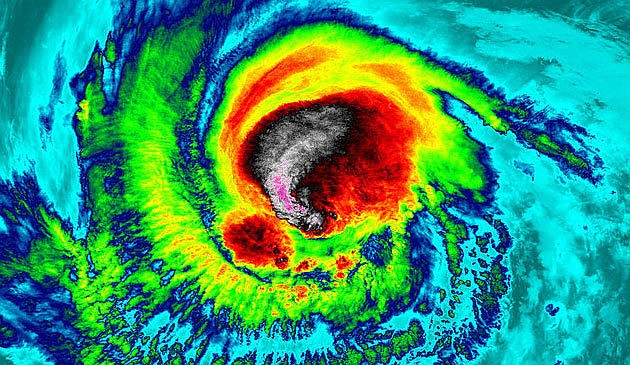

Who knows, as of this writing, where Hurricane Irma will decide to go. Suffice it to say, she’ll let herself be known to us no matter what.

And hopefully, by now, and several days ago, you refreshed your game plan for the possibility of a direct hit.

Some of the obvious steps:

Obviously, make special note of the contact numbers for your insurance agents, especially their cellphone numbers and email addresses. It’s a good idea to connect with them before Irma strikes so you’re clear on what to do after the storm.

There is much to be done, that’s for sure. And after watching what Hurricane Harvey did to Houston, that should be motivating you to be prepared for the worst.

If you’re unsure of all you need to do before and after Irma, the Red Cross posts a detailed checklist online. We’re posting it on online: YourObserver.com/red-cross-checklist.

Remember, too, the constant advice of two of Longboat Key’s former police chiefs, the late Wayne McCammon and Al Hogle. They always reminded Longboaters: If you’re crazy enough to stay on the Key to ride out a hurricane, just be sure to put a tag on your big toe with your name for identification. In other words, when public officials tell you to evacuate, go.

As we were all reminded over the past two weeks, the storm is one event. After the storm actually is a much bigger, longer event. Put it in perspective: The storm may last 48 hours. Recovery can last as much as 48 months.

And that’s what we want to emphasize: Be prepared for the aftermath — especially when you consider some of the accompanying data:

Few can forget Charley’s damage to our southern neighbors in Charlotte County and what it took to rebuild.

Good news is Citizens has declined from being the largest property insurer in Florida to fifth largest (5% market share), and it has had more than a decade to build up $7.5 billion in reserves.

If Irma, God forbid, inflicts, say, $30 billion in damage on the state, Citizens’ share of that could reach $1.5 billion, well within its means. All policyholders — no matter who the carrier is — would be spared from having the annual state assessments increased to help fund Citizens and the Florida Hurricane Catastrophe Fund.

In that same vein, many of the insurers that acquired policyholders from Citizens have not been tested, either. They have the capital to cover their claims, but the manpower is an unanswered question.

All of which points to your being as prepared for post-hurricane as you are for when, and if, Irma hits. To that end, the Insurance Information Institute has an excellent guide on the steps required to settle your claims. We have posted this guide online as well:

YourObserver.com/how-to-settle-your-claim-after-a-hurricane.

Meantime, we’ll pray we are spared. Be safe.