- April 24, 2024

-

-

Loading

Loading

It starts with Sarasota 2050 ... a countywide, comprehensive build-out plan that’s optional for developers. Although developers aren’t required to comply with the plan’s regulations, doing so allows them to build more units on their land. In addition, they can develop mixed-use projects instead of only residential projects.

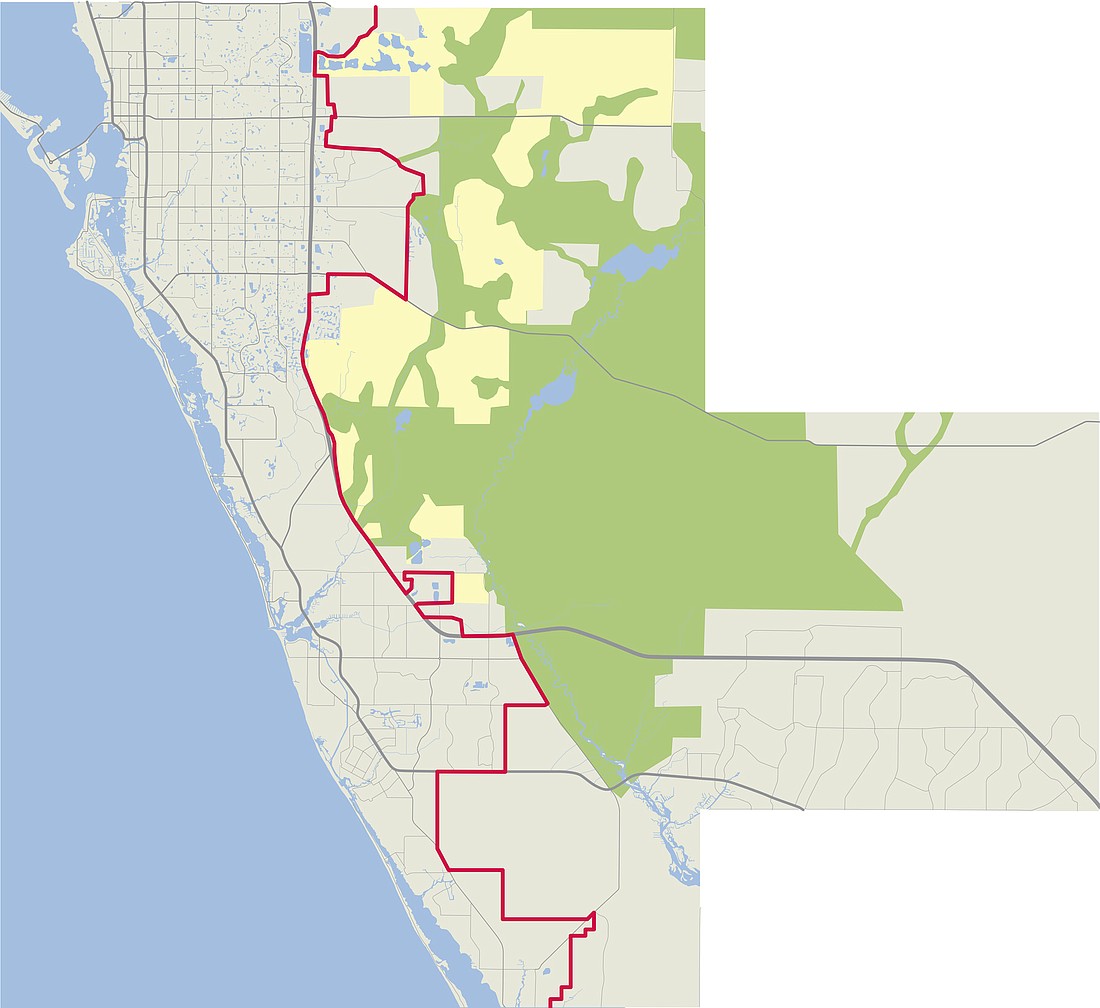

WHERE: The plan applies to unincorporated county land located east of the urban service boundary, which ends at I-75.

IN A NUTSHELL: Only three developments have been approved under Sarasota 2050 since the Sarasota County Commission approved it in July 2002. Based on feedback from developers, the county targeted fiscal neutrality for revision.

Definition

fis·cal neu·tral·i·ty

Fiscal neutrality is the requirement that developers demonstrate and be responsible for the public on- and off-site impacts and public infrastructure costs of their projects. They must ensure the cost of the development in terms of services, infrastructure and maintenance will equal the tax revenue it will generate once fully developed. In essence, it ensures that new developments pay for themselves and the infrastructure they require, such as roads, water and sewage. Its purpose is to keep the burden for these costs from shifting to existing county taxpayers.

WHAT’S CHANGING? The proposed changes to Sarasota 2050 are in their third phase. County staff has

proposed several areas in which they believe the plan could be updated or improved. Several proposed amendments to the fiscal neutrality provisions have proven to be controversial among many of the interested parties, including developers, residents, staff and financiers. We outline three of the major issues and their proposed solutions below.

1. Issue: Developers do not know what they will have to pay for in terms of impact fees and on- and off-site costs because the county doesn’t have a consistent method to calculate these costs.

Proposed Change: The county will create a consistent way of estimating costs the developer will have to pay. This allows the developer to operate off of a concrete budget and allows the county and public to know what the developer will be paying.

2. Issue: It’s difficult for a developer to prove fiscal neutrality at every stage of a project. Without exact costs, it’s difficult for developers to acquire financing needed for their projects.

Proposed Change: Instead of frequent assessments, the developer will have one long-term fiscal neutrality assessment due to the county at the beginning of a project. If the developer’s plans change significantly, he or she will be required to provide a new assessment. The developer will submit monitoring reports on fiscal neutrality throughout points of construction as the county chooses.

3. Issue: Because affordable housing generates less property tax, strict regulations on required affordable housing can deter developers because they will not be able to be fiscally neutral.

Proposed Change: The county will provide an incentive to developers for affordable housing. This incentive is an increase of two dwelling units for every affordable unit and an increase of one dwelling unit for every community housing unit. It is not an increase in physical units; it’s a decrease in the amount of area the developer must purchase as transfer of development rights (TDRs) land, which is open space, which often includes environmentally sensitive land.

So who’s for and who’s against the proposed changes? Below is a snapshot of the two sides of the debate.

Opposed

Dan Lobeck

Lobeck and Hanson, P.A.

Lobeck has been an outspoken opponent of the amendments and was one of the many who addressed the Sarasota County Planning Commission about his concerns at the July 24 public hearing. These are his critiques of the proposed amendments:

The amendment requires developers to pay only for regular impact fees and nothing else, including unexpected costs.

Only having one neutrality assessment at the beginning, with no further assessments unless construction changes, detracts from keeping a development constantly fiscally neutral.

The affordable-housing incentive is a “credit” for developers and allows them to skirt around actually meeting the fiscal-neutrality requirement, and the amendment gives them a “break.”

“All of these gut fiscal neutrality,” Lobeck said. “The county is trying to run this scam of ‘we’re not trying to change fiscal neutrality in any way.’”

The county is narrowing the fiscal neutrality section so much that is becomes meaningless, he said.

Support

Bill Merrill

Icard Merrill

Merrill was one of only two speakers at the July 24 Sarasota County Planning Commission public hearing who spoke in favor of the changes to Sarasota 2050. His arguments for the changes include:

The development will still require a long-term neutrality analysis upfront.

Developers will have to pay for a new assessment if a construction program changes.

Developers are still responsible for impact fees and on- and off-site costs.

The amendments allow developers to get bank financing more easily.

“The amendments are reasonable to bring fiscal neutrality into reality,” Merrill said.

Fiscal neutrality is an important tool for the county, he said, and the changes won’t eliminate that neutrality.

Next Discussion: The Sarasota County Commission will discuss two Sarasota 2050-related topics at a public hearing Aug. 27. One is to adopt a resolution transmitting comprehensive plan amendments to the Florida Department of Economic Opportunity for review; the second is the first of two public hearings to adopt a zoning ordinance amendment for 2050.