- April 16, 2024

-

-

Loading

Loading

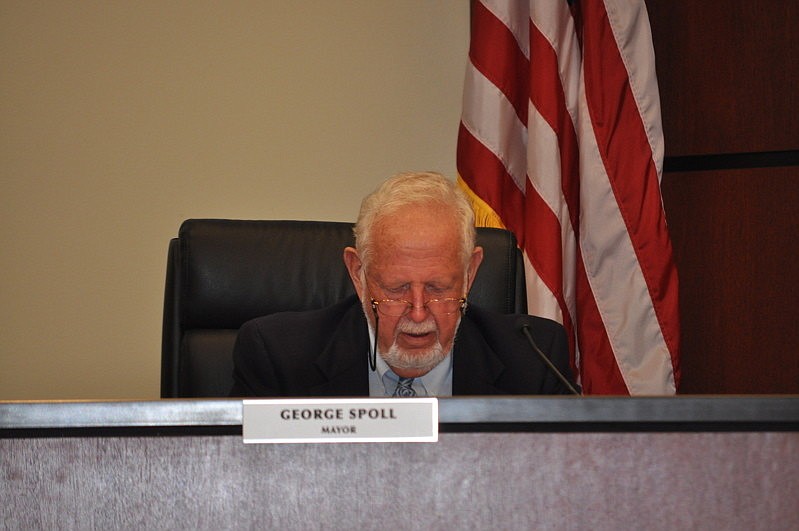

The town’s pension attorney believes the Firefighters Pension Board may have breached its fiduciary duty after requesting a forensic analysis of its pension.

The attorney’s conclusion concerned the Longboat Key Town Commission, which decided at its Monday, Oct. 4 regular meeting to allow town staff to draft a letter to the board that alerts its members of the commission’s concern of the study being performed.

Attorney James Linn wrote a six-page letter dated Oct. 1 to Town Manager Bruce St. Denis that included a past court example and a conclusion that read: “A strong case can be made that the town’s Firefighters Pension Board breached its fiduciary duty when it approved a proposal for a $50,000 pension analysis to be performed by Benchmark Financial Services.”

The Firefighters Pension Board decided to request the pension analysis at its Sept. 15 quarterly pension meeting, after five companies rejected its request to perform a $100,000 audit of the pension.

The majority of the five-person pension board, which has three firefighter members, believes the pension is under attack because of its $13 million in unfunded liability and wants to find out who is to blame for the problem.

But selecting Benchmark to perform the new analysis, without soliciting bids from any other companies, has raised the ire of both St. Denis and Commissioner Phillip Younger.

Because the pension board didn’t investigate whether another firm could perform the same service at a lower rate, Linn believes the board my have acted incorrectly.

Linn’s letter was presented in response to a list of questions from Younger, who has expressed issues with the pension board’s decision.

In an e-mail sent to St. Denis dated Sept. 15, Younger asked the following questions:

• Is the pension board authorized to spend pension funds or any town funds regardless of the amount, whether it is $5, $50,000 or $5 million, for any purpose other than retirement benefits and investments for retirement benefits?

• Can the pension board “cherry pick” a particular entity to perform any such function or must they, as a public body, without following legally established Request for Proposal (RFP) procedures, especially since a prior RFP approved by the Firefighters Pension Board for a then-termed “forensic” investigation that was released in February 2010, with an expiration date of Sept. 13, 2010, resulted in no parties bidding for performance, including the now “cherry picked” entity under differing auspices?

• Can the pension board approve any contract that is worded in such a manner as to focus entirely on town activities, to the exclusion of Firefighters Pension Board decisions?

• Is the effort by the pension board to do as stated above in accordance with its fiduciary responsibilities?

In answering Younger’s questions, Linn said the pension board is not required to follow Request for Proposal procedures.

“However, the board has a fiduciary duty to investigate the reasonableness of the fees it pays for professional services and to evaluate whether the same services are available at a lower cost,” Linn wrote. “For this reason, many public pension boards routinely follow the RFP process when selecting advisers and consultants.”

But Firefighters Pension Board attorney Bob Sugarman said that he believed the board was acting within its authority.

Sugarman believes the board had the right to engage Benchmark to review decisions made that affected the plan and its $13 million in unfunded liabilities. Sugarman said the board would review a more concrete proposal at its Wednesday, Nov. 10 meeting, when the contract can officially be signed.

But the commission hopes the pension board will reconsider signing a contract after reading Linn’s assessment of its decision.

“I don’t want to see them do this,” said Commissioner David Brenner. “They need to understand the concern that exists here on the commission.”

St. Denis received direction from the commission to work with Linn to draft a letter outlining the commission’s concerns that will be sent to the pension board before its next meeting.

The pension board, however, doesn’t act under the authority of the Town Commission and has the right to make any decisions it deems necessary.

But because taxpayer dollars are used to fund the unfunded plan, town labor attorney Reynolds Allen told the commission it could use the legal system to stop the action.

“If they don’t show any willingness to cooperate, I think the town should go to another level,” Younger said.

Town attorney David Persson, meanwhile, told The Longboat Observer that it’s neither in the town’s best interest, nor is it in the pension board’s best interest “to point fingers” and question why the town has amassed more than $20 million in unfunded liability in all three of its pensions (firefighter, police and general employees).

“We are where we are, and pointing fingers and having 27 different attorneys and companies review what a pension board did doesn’t solve the problem,” said Persson, who believes the pension boards’ fiduciary responsibilities are broad. “The problem is we have a significant pension liability and the sooner the town and the pension boards come together to reach a solution, the better off we will be.”

Contact Kurt Schultheis at [email protected].