- April 19, 2024

-

-

Loading

Loading

You know the old joke about the Legislature: Every time it goes into session hold on to your wallet.

In truth, it’s safe to say a wide majority of working Floridians, snowbirds and retirees pay little attention to the day-to-day minutiae of the Legislature. For the most part, lawmakers tend to work in the margins and avoid creating big drama that would affect their re-elections.

Only when they start futzing with things like whether you can carry a gun or smoke weed do the masses seem to get stoked and involved.

Even so, in spite of the tepid interest in most legislative sessions, we make a point of tuning in on the opening day to the governor’s State of the State address. It often serves as a signal of what will be big over the next 60 days.

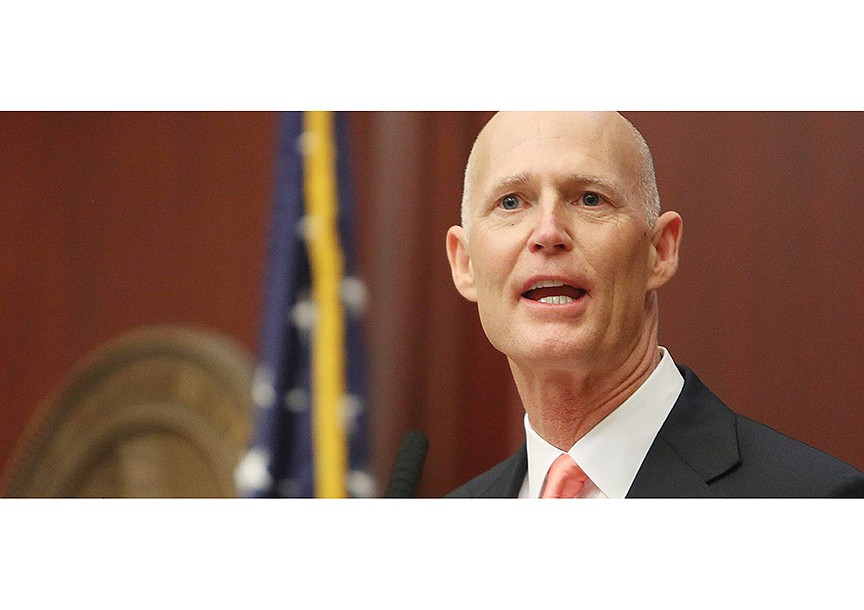

To little surprise, Gov. Rick Scott hit his replay button Tuesday and focused on the same three issues that have consumed him for the past six years — jobs, jobs, jobs. He did this, more specifically, by urging lawmakers to take $1 billion of Florida’s expected revenue surplus to cut business and other taxes and $250 million of it to create a new trust fund for corporate recruiting. The businesses’ tax cuts actually would total $1.18 billion over the next three fiscal years (see box).

Lawmakers, of course, reacted according to party line — Democrats blowing gaskets, most Republicans expressing caution. None of them ever wants to promise anything on the first day. They know this annual poker game requires them to hold their cards until they have a clearer picture of whether there will be other preferred ways to spend that surplus or give it back to taxpayers via tax cuts.

Predictably, Florida’s media pundits and statists responded to Scott’s tax-cut request with utter disgust. You know how it goes. They jumped all over him for not focusing on increasing Medicaid and mental-health spending; more spending on schools and the environment; and the usual social laundry list. But they especially teed off on Scott for proposing “corporate welfare” and tax cuts that would help only his favorite special interest: business. There is nothing, they said, for the little people.

On these latter points — tax cuts for the business special interest and none for average Floridians — this is when we wish all of these critics actually would realize that what Scott said in his speech is so, so right. Said Scott:

“Government does not create prosperity, and it never has. Top down mandates from big government are artificial and not sustainable.

“Real prosperity is created by the ingenuity and hard work of the American people … I believe that the best way to help our weakest, our poorest and our most disadvantaged neighbors live their dreams is to help them get a job … A job is the number one way to change any person’s life for the better …”

A few weeks ago, we noted this same point, quoting Arthur Brooks, president of the American Enterprise Institute and a scholar on social entrepreneurship. Brooks has found through research that having and succeeding at a job is the secret to happiness.

And surely, everyone understands government is not the source of wealth. If, for instance, government ascribes tax revenue to build bridges or schools or to employ cops or teachers, it has obtained the money to do so by taking it from someone else — by lowering the wealth of the person from whom it confiscates.

And here is a greater point the critics of business tax cuts seldom can see or believe: Businesses do not pay taxes. Individuals do.

The burden of business taxes ultimately always falls on individuals — e.g., lower wages for employees; lower dividends and return on investment to shareholders; and less available capital for the business owners to reinvest in their companies to grow and create more jobs.

Whenever the statists and progressives howl for more and higher business taxes or against tax cuts for business, they are campaigning for policies that, especially, in the end, hurt the little people most.

Sure, Scott could have done what most governors and presidents do in their State of the State or Union addresses — spouted off a checklist of issues and concerns to please everyone. But when you cut through all of those big government issues, the ones that matter most to the electorate are tied to Abraham Maslow’s hierarchy of needs. To achieve happiness, people first want their basic needs met. And the first two are: 1) physiological (food and water); and 2) security (personal and financial).

To accomplish 1 and 2, it most certainly requires most of us to have a job.

Don’t dis Gov. Scott. Give him credit for staying focused on what matters most.